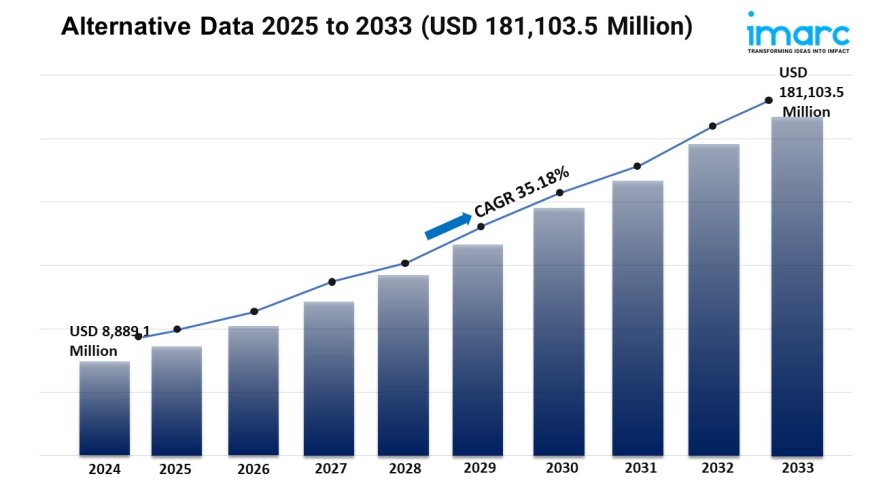

Alternative Data Market Share, Growth, and Trends Report 2025-2033

The global alternative data market size reached USD 8,889.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,81,103.5 Million by 2033, exhibiting a growth rate (CAGR) of 35.18% during 2025-2033.

Market Overview:

The alternative data market is experiencing rapid growth, driven by surge in demand for data-driven decision-making, advancements in ai and data analytics, and expansion of e-commerce and digital platforms. According to IMARC Groups latest research publication, Alternative Data Market Report by Data Type (Mobile Application Usage, Credit and Debit Card Transactions, Email Receipts, Geo-Location (Foot Traffic) Records, Satellite and Weather Data, Social and Sentiment Data, Web Scraped Data, Web Traffic, and Others), End Use Industry (Transportation and Logistics, BFSI, Retail and ECommerce, Energy and Utilities, IT and Telecommunications, Media and Entertainment, and Others), and Region 2025-2033. The globalalternative data market sizereachedUSD 8,889.1 Millionin 2024. Looking forward, IMARC Group expects the market to reachUSD 1,81,103.5 Millionby 2033, exhibiting a growth rate(CAGR) of 35.18%during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report:https://www.imarcgroup.com/alternative-data-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends And Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors Driving the Alternative Data Industry

- Surge in Demand for Data-Driven Decision-Making:

Businesses across industries are hungry for insights that go beyond traditional data like financial reports. Alternative data, such as social media sentiment or satellite imagery, offers real-time glimpses into consumer behavior and market trends. For example, over 70% of U.S. asset managers now integrate alternative data into their investment strategies, reflecting its growing value. Companies like J.P. Morgan Chase leverage transaction data to refine investment plans, while retail giants analyze foot traffic to optimize store performance. This demand is fueled by the need for a competitive edge in fast-moving markets, where timely decisions can make or break success. As organizations prioritize agility and precision, alternative data has become a go-to tool for smarter strategies and better outcomes.

- Advancements in AI and Data Analytics:

The explosion of artificial intelligence and machine learning is supercharging the alternative data industry. These technologies make it easier to process massive, unstructured datasetslike web-scraped content or IoT sensor dataturning them into actionable insights. For instance, hedge funds use natural language processing to analyze earnings call transcripts, extracting sentiment that influences stock picks. Recent partnerships, like SymphonyAIs acquisition of 1010data, highlight how companies are investing in AI-driven analytics to handle complex data. With global internet penetration now over 64%, according to the World Bank, the sheer volume of data from connected devices is staggering. These advancements allow firms to uncover patterns and predict trends with unprecedented accuracy, making alternative data indispensable for industries like finance and retail.

- Expansion of E-Commerce and Digital Platforms:

The booming e-commerce sector is a major driver for alternative data growth. As online shopping platforms like Amazon gather vast amounts of transactional and behavioral data, businesses tap into this to understand consumer preferences. For example, credit and debit card transaction data, which accounts for a significant market share, helps retailers identify spending patterns by demographics. The rise of digital platforms also fuels data generationthink mobile app usage or web traffic analytics. Government initiatives pushing digital transformation, especially in regions like Asia-Pacific, are accelerating this trend. Countries like China and India see heavy use of mobile app data to track economic activity. This digital shift creates a goldmine of alternative data, enabling businesses to fine-tune strategies and expand into new markets.

Trends in the Global Alternative Data Market

- Rise of ESG-Focused Data:

Environmental, Social, and Governance (ESG) data is gaining traction as companies and investors prioritize sustainability. Alternative data, like satellite imagery tracking deforestation or social media sentiment on corporate practices, helps assess ESG performance. For instance, investors use satellite data to monitor pollution levels near manufacturing plants, ensuring compliance with environmental standards. A recent report noted that 74% of firms see alternative data as critical for institutional investing, especially for ESG strategies. Providers like Dataminr are launching platforms to deliver real-time ESG insights, helping businesses align with global sustainability goals. This trend reflects growing pressure for transparency and ethical practices, making ESG-focused alternative data a powerful tool for responsible decision-making across industries like finance and manufacturing.

- Real-Time Analytics for Faster Decisions:

The demand for real-time insights is reshaping the alternative data market. Unlike traditional data, which can lag, sources like geolocation records or social media provide up-to-the-minute information. Hedge funds, for example, analyze foot traffic data to predict retail earnings before quarterly reports. In 2023, financial institutions reported that 62% use alternative data for risk profiling, per the State of Alternative Credit Data Report. Companies like Advan Research have expanded their geolocation data to cover 2,790 businesses, enabling investors to act swiftly on market shifts. This trend is critical in fast-paced sectors like trading, where milliseconds matter, and its pushing providers to develop platforms that deliver instant, actionable insights for competitive advantage.

- Growth of IoT and Sensor Data:

The Internet of Things (IoT) is revolutionizing alternative data with a flood of information from connected devices. With an estimated 50 billion IoT devices in use globally, per the International Telecommunication Union, sensors in smart meters, wearables, and industrial equipment generate rich datasets. For example, logistics firms use IoT data to optimize supply chains, while financial institutions analyze sensor data to monitor factory output. Partnerships like BattleFins collaboration with LSEG highlight efforts to harness IoT data for investment opportunities. This trend is driven by the need for granular insights into operational and consumer trends, making IoT data a game-changer for industries like transportation, energy, and finance, where real-time visibility is critical.

Leading Companies Operating in the Global Alternative Data Industry:

- 1010Data Inc. (Advance Communication Corp.)

- Advan Research Corporation

- Dataminr Inc.

- Eagle Alpha

- M Science

- Nasdaq Inc.

- Preqin

- RavenPack

- The Earnest Research Company

- Thinknum Inc.

Alternative Data Market Report Segmentation:

By Data Type:

- Mobile Application Usage

- Credit and Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Satellite and Weather Data

- Social and Sentiment Data

- Web Scraped Data

- Web Traffic

- Others

Credit and debit card transactions hold the biggest market share attributed to their ability to provide real-time insights into user spending behavior.

By End Use Industry:

- Transportation and Logistics

- BFSI

- Retail and ECommerce

- Energy and Utilities

- IT and Telecommunications

- Media and Entertainment

- Others

BFSI represents the largest segment, as these sectors heavily rely on alternative data for investment decisions, risk assessment, and user insights.

Regional Insights:

- North America: (United States, Canada)

- Asia Pacific: (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe: (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America: (Brazil, Mexico, Others)

- Middle East and Africa

North America dominates the market owing to its advanced financial sector, high technological adoption rates, and the presence of key players in the alternative data industry.

Research Methodology:

The report employs acomprehensive research methodology, combiningprimary and secondary data sourcesto validate findings. It includesmarket assessments, surveys, expert opinions, and data triangulation techniquesto ensureaccuracy and reliability.

Note:If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the worlds most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email:sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145