BOPP Films Market Size, Trends, Growth, and Forecast 2025-2033

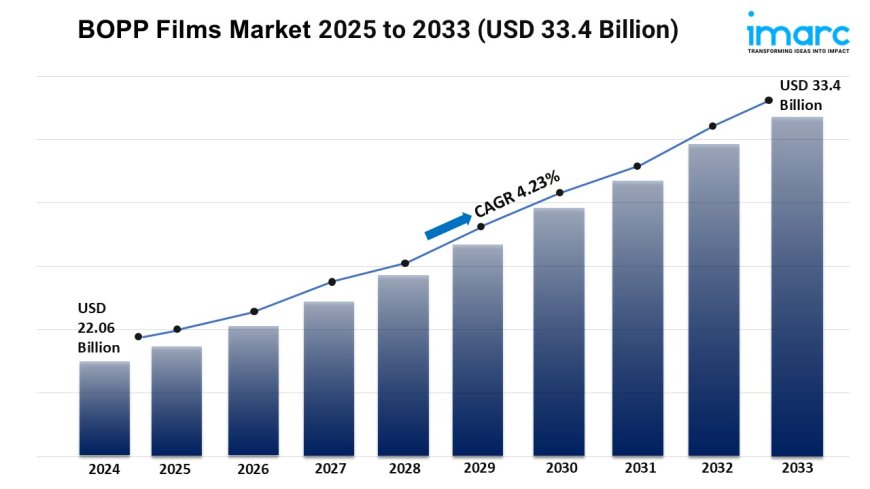

The global BOPP films market size was valued at USD 22.06 Billion in 2024. The market is projected to reach USD 33.4 Billion by 2033, exhibiting a CAGR of 4.23% from 2025-2033.

Market Overview:

The BOPP films market is experiencing rapid growth, driven by rising demand for sustainable packaging, growth in e-commerce and retail, and technological advancements in manufacturing. According to IMARC Group's latest research publication, "BOPP Films Market Report by Type (Wraps, Bags and Pouches, Tapes, Labels, and Others), Thickness (Below 15 Microns, 15-30 Microns, 30-45 Microns, More Than 45 Microns), Production Process (Tenter, Tubular), Application (Food, Beverage, Tobacco, Personal Care, Pharmaceutical, Electrical and Electronics, and Others), and Region 2025-2033". The global BOPP films market size reachedUSD 22.1 Billionin 2024. Looking forward, IMARC Group expects the market to reachUSD 33.4 Billionby 2033, exhibiting a growth rate(CAGR) of 4.23%during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/bopp-films-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends And Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors Driving the BOPP Films Industry

- Rising Demand for Sustainable Packaging:

The push for eco-friendly packaging is a huge driver for the BOPP films industry, influencing the overall BOPP film market. Consumers and brands are prioritizing sustainability, and BOPP films are stepping up with recyclable and biodegradable options. A recent study noted that 70% of global consumers prefer sustainable packaging, boosting demand for greener BOPP variants. Companies like Amcor are investing heavily in compostable BOPP films, with their AmLite line gaining traction in food packaging. Government initiatives, like the EUs Single-Use Plastics Directive, are also encouraging recyclable materials, creating a favorable environment for the BOPP film market. This shift is evident in the food and beverage sector, where BOPP films are used for snack packaging, with a reported 35% market share in flexible packaging, making them a go-to choice for brands aiming to meet sustainability goals within the BOPP film market.

- Growth in E-Commerce and Retail:

The e-commerce boom is fueling BOPP film demand due to their durability and versatility in packaging. With global online retail sales hitting $5.8 trillion, the need for lightweight, protective packaging like BOPP films has skyrocketed. These films are ideal for pouches and labels, offering moisture resistance and printability for branding. Major players like Mondi have ramped up production, with their FlexiCoat line tailored for e-commerce packaging. Government schemes, such as Indias Digital India initiative, are indirectly boosting e-commerce, increasing BOPP film usage for logistics. Statistics show that 40% of BOPP films are used in bags and pouches, reflecting their dominance in retail applications. As online shopping grows, especially in Asia-Pacific markets like China, BOPP films are becoming essential for secure, cost-effective packaging solutions.

- Technological Advancements in Manufacturing:

Innovations in manufacturing are making BOPP films more efficient and appealing. Advanced extrusion technologies are improving film strength and clarity, reducing production costs by up to 15%, according to industry reports. Companies like Jindal Poly Films are adopting AI-driven production systems to optimize output and quality. These advancements allow BOPP films to cater to diverse industries, from pharmaceuticals to cosmetics, where high-barrier films are critical. Government incentives, such as tax breaks for adopting smart manufacturing in India, are encouraging companies to upgrade facilities. The result is a surge in high-performance BOPP films, with 25% of the market now focused on specialty films for applications like medical packaging. This tech-driven growth is helping manufacturers meet rising global demand while keeping costs competitive.

Trends in the Global BOPP Films Market

- Shift Toward Biodegradable BOPP Films:

Sustainability is reshaping the BOPP films market, with biodegradable variants gaining ground. As environmental concerns grow, companies are developing eco-friendly films to replace traditional plastics. For example, Cosmo Films launched a compostable BOPP film used by brands for snack packaging, reducing plastic waste. Data shows that 60% of packaging firms are exploring biodegradable options due to consumer demand. These films maintain durability and printability, making them ideal for food and beverage applications. Real-world use includes biodegradable BOPP pouches for organic products, which have seen a 20% sales increase in Europe. This trend aligns with global regulations pushing for circular economies, encouraging manufacturers to innovate while meeting strict environmental standards, ensuring BOPP films remain relevant in a greener future.

- Integration of Smart Packaging Technologies:

Smart packaging is an exciting trend in the BOPP films market, with films now featuring embedded sensors and QR codes for interactivity. These innovations enhance consumer engagement and supply chain tracking. For instance, Uflex introduced BOPP films with anti-counterfeit features for pharmaceutical packaging, addressing the $200 billion global counterfeiting issue. Statistics indicate that 15% of BOPP films are now used in smart packaging applications, like labels with traceability codes for food safety. Real-world examples include BOPP films with QR codes on beverage pouches, allowing consumers to access product details. This trend is driven by the rise of IoT and consumer demand for transparency, pushing manufacturers to invest in high-tech films that offer both functionality and branding opportunities. (133 words)

- Expansion in Emerging Markets:

The BOPP films market is booming in emerging economies, particularly in Asia-Pacific, due to rapid urbanization and rising consumer goods demand. China and India account for 45% of global BOPP film consumption, driven by their growing food and beverage sectors. Companies like Polyplex are expanding production in India, with new plants boosting capacity by 30,000 tons annually. Urbanization has increased packaged goods consumption, with BOPP films used in 50% of snack packaging in these regions. Government schemes, like Indias Make in India, support local manufacturing, further driving growth. Real-world applications include BOPP films for instant noodle packaging, a $40 billion market in Asia. This trend highlights the regions role as a key growth hub for BOPP films.

Leading Companies Operating in the Global BOPP Films Industry:

- Altopro S.A. de C.V.

- Amcor Plc

- Ampacet Corporation

- Chiripal Poly Films Limited

- Clondalkin Flexible Packaging

- Cosmo Films Limited

- Futamura Chemical Co. Ltd.

- Innovia Films Limited (CCL Industries)

- Jindal Poly Films Limited

- Mondi Plc

- Polyplex Corporation Ltd.

- Printpack Holdings Inc.

- Toray Industries Inc.

- Uflex Ltd.

BOPP Films Market Report Segmentation:

By Type:

- Wraps

- Bags and Pouches

- Tapes

- Labels

- Others

Bags and pouches represent the largest segment due to their versatility, suitability for various packaging needs across industries, and the rising demand for convenient and portable packaging solutions.

By Thickness:

- Below 15 microns

- 15-30 microns

- 30-45 microns

- More than 45 microns

15-30 microns account for the majority of the market share owing to their balanced combination of strength, flexibility, and cost-effectiveness, making them suitable for a wide range of packaging applications while meeting performance requirements and cost considerations.

By Production Process:

- Tenter

- Tubular

On the basis of the production process, the market has been bifurcated into tenter and tubular.

By Application:

- Food

- Beverage

- Tobacco

- Personal Care

- Pharmaceutical

- Electrical and Electronics

- Others

Food exhibits a clear dominance in the market driven by stringent food safety regulations, increasing consumer demand for packaged food products, and the superior barrier properties of BOPP films, which help maintain food freshness and extend shelf life.

Regional Insights:

- North America: (United States, Canada)

- Asia Pacific: (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe: (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America: (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific enjoys the leading position in the BOPP films market on account of its rapid industrialization, expanding food and beverage (F&B) industry, growing consumer base, and strong manufacturing capabilities.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the worlds most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145