Synthetic Paper Market Size, Growth & Forecast 2025-2033

The global synthetic paper market size reached USD 1,076.1 Million in 2024. Looking forward, the market is projected to reach USD 1,949.7 Million by 2033, exhibiting a growth rate (CAGR) of 6.49% during 2025-2033.

Market Overview:

The synthetic paper market is experiencing rapid growth, driven by rising demand for sustainable packaging, expansion of e-commerce and labeling needs, and growth in pharmaceutical and healthcare applications. According to IMARC Group's latest research publication, "Synthetic Paper Market Report by Type (Biaxially Oriented Polypropylene (BOPP), High Density Polyethylene (HDPE), Polyethylene Terephthalate (PET), and Others), Application (Label, Non-Label), End Use Industry (Industrial, Institutional, Commercial/Retail), and Region 2025-2033", the global synthetic paper market size reachedUSD 1,076.1Millionin2024. Looking forward, the market is projected to reachUSD 1,949.7Millionby2033, exhibiting a growth rate(CAGR) of 6.49%during2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/synthetic-paper-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Synthetic Paper Market

- Rising Demand for Sustainable Packaging

Consumers and businesses are increasingly prioritizing eco-friendly packaging, pushing the synthetic paper industry forward. Unlike traditional paper, synthetic paper, made from materials like polypropylene or polyethylene, is recyclable and reduces reliance on wood pulp, helping curb deforestation. For instance, a report highlights that synthetic paper production uses significantly less freshwater than conventional paper, aligning with global sustainability goals. Companies like Cosmo Films have launched recyclable synthetic paper products, gaining traction in markets like food and beverage, where durable, eco-conscious packaging is critical. Government initiatives, such as the European Unions regulations on reducing single-use plastics, further boost demand by encouraging alternatives like synthetic paper for labels and packaging. This shift reflects a broader movement toward greener practices, driving industry growth as brands meet consumer and regulatory expectations.

- Expansion of E-Commerce and Labeling Needs

The boom in e-commerce, particularly in regions like Asia-Pacific, is fueling demand for synthetic paper in labeling and packaging. With online retail giants like Amazon and Alibaba expanding, durable labels that withstand shipping conditions are essential. Synthetic papers resistance to moisture and tearing makes it ideal for barcodes and product tags. For example, in China, the packaging sector relies heavily on synthetic paper for high-volume logistics, with millions of packages shipped daily. Companies like Yupo Corporation report increased orders for labels used in e-commerce. This growth is supported by rising disposable incomes in developing nations, boosting consumer goods sales and, consequently, the need for robust packaging solutions. As e-commerce continues to surge, synthetic papers role in reliable labeling drives significant industry expansion.

- Growth in Pharmaceutical and Healthcare Applications

The pharmaceutical and healthcare sectors are leaning on synthetic paper for its durability and compliance with strict regulations. Used for medical tags and prescription labels, synthetic paper resists moisture and tampering, ensuring critical information remains intact. For instance, in North America, the healthcare industrys demand for synthetic paper is strong due to its ability to endure extreme conditions, like cryogenic storage. Companies like Agfa-Gevaert have introduced products like SYNAPS XM110, a thin synthetic paper tailored for medical labeling. Government regulations, such as the U.S. FDAs stringent labeling standards, further push adoption. With global healthcare spending risingestimated at over $10 trillion annuallysynthetic papers role in reliable, long-lasting labeling solutions is a key driver of industry growth, especially in high-stakes applications.

Key Trends in the Synthetic Paper Market

- Shift Toward Biodegradable Synthetic Paper

Sustainability is reshaping the synthetic paper market, with a growing focus on biodegradable variants. Manufacturers are developing papers from bio-based polymers to reduce reliance on petrochemicals. For example, Cosmo Films recently introduced a biodegradable synthetic paper for food packaging, aligning with global zero-waste goals. This trend is driven by consumer demand for greener products, with surveys showing 70% of consumers prefer eco-friendly packaging. In Europe, regulations banning non-recyclable plastics are pushing companies to innovate. These biodegradable papers maintain durability while decomposing faster than traditional plastics, appealing to industries like retail and cosmetics. As environmental awareness grows, especially in markets like Asia-Pacific, biodegradable synthetic paper is gaining traction, offering a balance of performance and eco-consciousness thats transforming the industry.

- Advancements in Printing Technology Compatibility

Innovations in printing technology are expanding synthetic papers applications. New formulations allow compatibility with digital, offset, and flexographic printing, enhancing print quality and versatility. For instance, PPG Industries has developed synthetic papers optimized for high-resolution digital printing, widely used in advertising and retail displays. This trend is critical as businesses demand vibrant, durable prints for banners and labels. In Japan, the print industrys adoption of synthetic paper has surged, with millions of square meters used annually for promotional materials. These advancements also lower production costs, making synthetic paper more accessible. As printing technologies evolve, synthetic papers ability to deliver sharp, long-lasting graphics positions it as a go-to material for industries seeking eye-catching, durable solutions.

- Increasing Use in Premium Packaging

Synthetic paper is becoming a favorite for premium packaging in industries like cosmetics and food and beverage. Its durability, water resistance, and high-quality printability make it ideal for luxury branding. For example, in Germany, brands use synthetic paper for wine and cosmetic labels to enhance shelf appeal, with studies showing premium packaging can boost sales by up to 15%. Companies like Arjobex are supplying synthetic paper for high-end retail, meeting demand for visually striking, durable packaging. In Asia-Pacific, the rise of luxury goods markets, especially in China, drives this trend, with synthetic paper used in millions of premium product packages annually. As brands prioritize aesthetics and functionality, synthetic papers role in upscale packaging continues to grow, shaping market dynamics.

Leading Companies Operating in the Global Synthetic Paper Industry:

- Agfa-Gevaert N.V.

- Aluminium Fron GmbH & Co. KG

- Arjobex SAS

- Cosmo First Limited

- HOP Industries Corporation

- MDV Papier- und Kunststoffveredelung GmbH

- Nan Ya Plastics Corporation

- PPG Industries Inc.

- RELYCO

- Seiko Epson Corporation

- Toyobo Co. Ltd.

- Transcendia Inc.

- Yupo Corporation

Synthetic Paper Market Report Segmentation:

By Type:

- Biaxially Oriented Polypropylene (BOPP)

- High Density Polyethylene (HDPE)

- Polyethylene Terephthalate (PET)

- Others

Biaxially Oriented Polypropylene segment accounts for the majority of the market share, characterized by excellent printability, clarity, and resistance to moisture and chemicals, making it ideal for labels, packaging, and advertising materials.

By Application:

- Label

- Hand Tags

- Medical Tags

- Others

- Non-Label

- Packaging

- Documents

- Others

Non-Label segment holds the largest share in the industry, encompassing various uses across industries such as printing, packaging, and manufacturing, where synthetic paper's versatility and durability are essential.

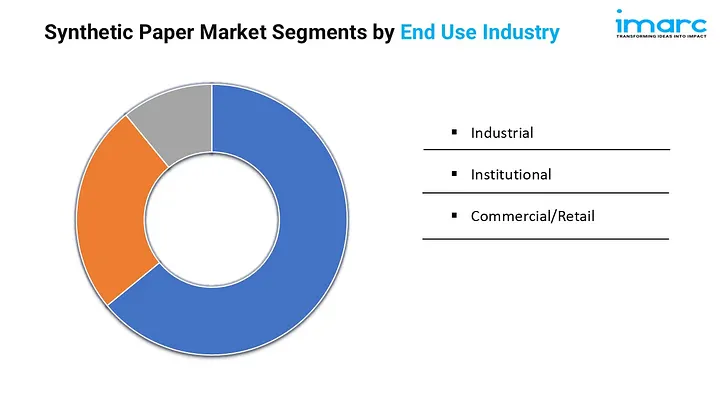

By End Use Industry:

- Industrial

- Institutional

- Commercial/Retail

Industrialsegment represents the leading market segment, primarily involving technical and functional applications, including labels for chemical containers and outdoor signage, due to its durability and resistance to harsh conditions.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific region leads the market, accounting for the largest synthetic paper market share among all regions analyzed.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the worlds most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145